Money 4 5 5 – Personal Accounting App

- Money 4 5 5 – Personal Accounting Approach

- Free Personal Accounting Apps

- Money 4 5 5 – Personal Accounting Approaches

- Money 4 5 5 – Personal Accounting Apps

Download this app from Microsoft Store for Windows 10. Read the latest customer reviews, and compare ratings for Family Accounting. Download this app from Microsoft Store for Windows 10. See screenshots, read the latest customer reviews, and compare ratings for Family Accounting. Rated 4.5 out of 5 stars. There are 1555 reviews.

Run your home like you’d run your business. Or run a business out of your home. Either way, with QuickBooks you can organize all those expenses, payments and other transactions—all in one place.

Paid versions of personal finance apps vary in price but are relatively inexpensive, about $25 per year. Other apps only offer one version and it’s free. So, if you need some extra help managing your finances, a personal finance app can be an affordable way to help. How We Chose the Best Personal Finance Apps. These 8 best personal finance. This personal financial app, from financial guru Dave Ramsey, blends budgeting into your bank account to give you a snapshot of where you stand financially, and where you're going.

Run your home from anywhere.

Get more done everywhere.

Everything you need—checks, receipts, online banking access—is there when you need it. Datagrip 2016 2 2 – new database ide. Because QuickBooks syncs it all instantly on your phone, tablet and computer.

Run your home from anywhere. So you can get more done.

- Pay people on time, every time

- Track purchases & expenses

- Finances automatically updated

- Balance checkbooks & budgets

- Make tax time easier

Free Mobile Apps

Access your QuickBooks data on the go with apps for iPad, iPhone, and Android.1

Shop QuickBooks Add-ons

Choose from over 100 small business add-ons and apps that work with QuickBooks.2

Find a QuickBooks Expert

Find local Certified QuickBooks ProAdvisors who have been tested and certified on Quickbooks.3

- QuickBooks Online requires a computer with a supported Internet browser (see System Requirements for a list of supported browsers) and an Internet connection (a high-speed connection is recommended). The QuickBooks Online mobile app works with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Not all features are available on the mobile apps and mobile browser. QuickBooks Online mobile access is included with your QuickBooks Online subscription at no additional cost. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. Product registration required.

- Add-ons sold separately. Additional terms, conditions and fees may apply.

- Intuit does not warrant or guarantee the quality of QuickBooks ProAdvisors’ (either certified or non certified) work and Intuit is not responsible for any errors, acts or omissions of Certified QuickBooks ProAdvisors or non-certified QuickBooks ProAdvisors.

Terms, conditions, pricing, features, service and support are subject to change without notice. Standard message and data rates may apply. iPad, iPhone, Safari, and Apple are trademarks of Apple Inc. Android and Chrome are trademarks of Google Inc. Microsoft, Internet Explorer, and Windows are either registered trademarks or trademarks of Microsoft Corporation in the United States and/or other countries. The Trademark BlackBerry® is owned by Research In Motion Limited and is registered in the United States and may be pending or registered in other countries. Intuit Inc. is not endorsed, sponsored, affiliated with or otherwise authorized by Research In Motion Limited.

Ten years ago, there were no solid personal finance apps out there. If you wanted to track your money, you didn't have many options beyond websites like Google Finance. I got my start tracking our budget and net worth with a spreadsheet. I would learn about Intuit's Quicken software but it felt silly to pay for software to help me save money. It wasn't until later that other personal finance tools started to appear.

The best personal finance software works like a money management app that gives you an instant snapshot of your financial situation in seconds. A lot of the problems we face when dealing with money is how much time it takes to stay on top of things. A good personal finance app will help you save time and money.

Earlier this year I polled the readers of Wallet Hacks for their “must-have, can't live without” money apps. I compiled their responses and made the following list of best personal finance software (most of which have a mobile app).

Best Money Management App – Personal Capital

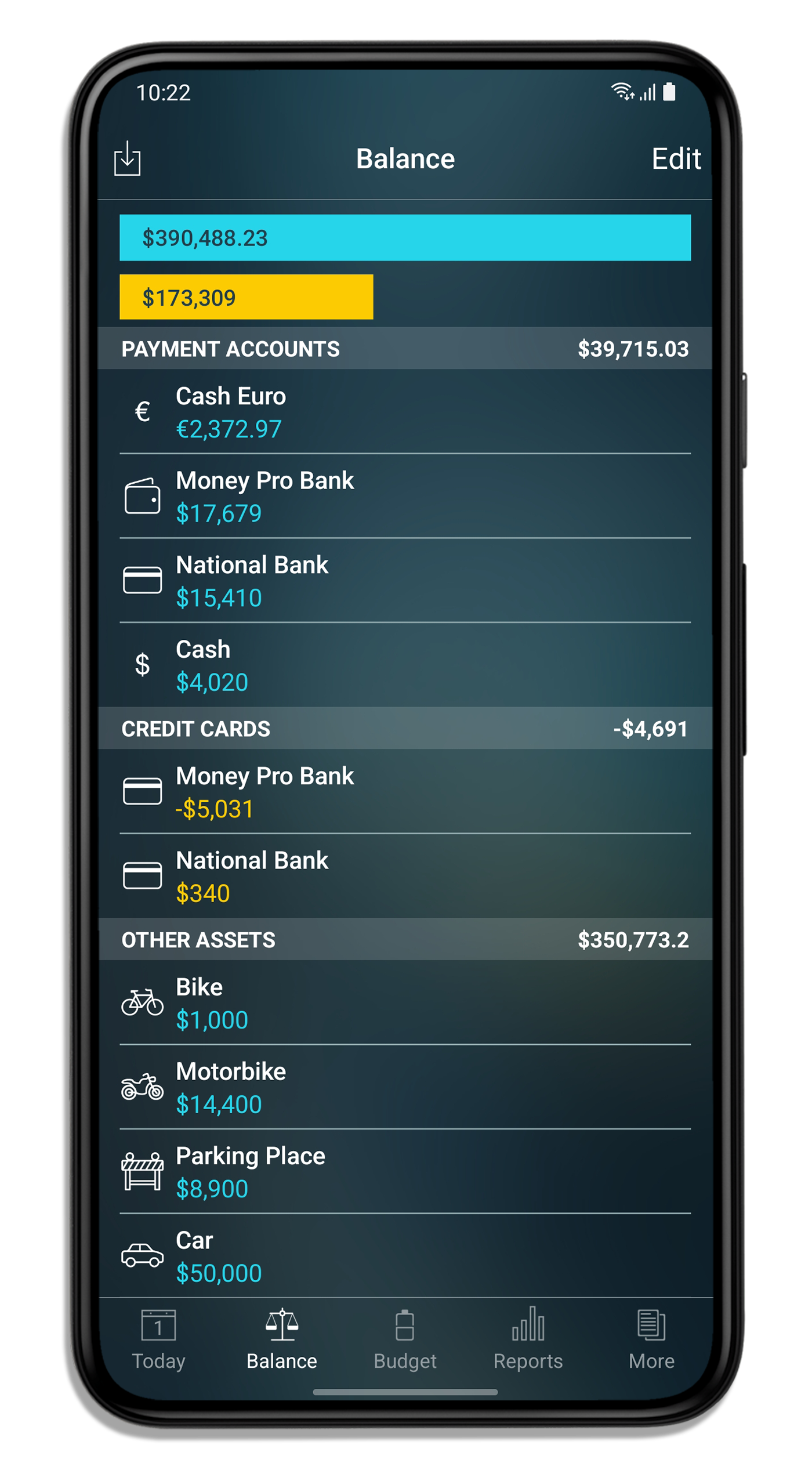

A financial dashboard is a place where you can see everything involving your money in one place. Your assets, your liabilities, your net worth – all your financial accounts visible on one convenient page.

Hard drives that work on mac and pc. This is important because when that information is easily accessible, it's easily remembered and understood. We use it to pull in all of our data, though we ignore the credit card debt piece because we pay off our bills every month in full.

What's easier – logging into one account or logging into a dozen?

When it comes to a financial dashboard, the clear leader is Personal Capital. It has a rich suite of tools built around investments, with a nod towards expense tracking similar to Mint, so you can get a sense of where everything is at a moment's notice. If you're interested in a consultation with a financial advisor, they have that built-in as well and it's something that helps them stand out from other similar services. It's how Personal Capital makes the money that supports the free tool.

This app is for you if: You want an instant snapshot of your finances, from your investments to your budget, in one place. Personal Capital is free.

Best Budgeting App – You Need a Budget

If you want to change your budget, You Need a Budget (YNAB) is one of the most powerful tools you can use because it does more than track your expenses – it actually helps you build and stick to a budget.

One of the biggest challenges in money management is in near-term planning. What are you going to do next week and next month?

Money 4 5 5 – Personal Accounting Approach

Retirement can be decades away but you are spending money today and tomorrow. By getting the next month right, you go a long way towards getting your money situation under control.

YNAB has a four rule methodology that has worked well for its users.

- Give Every Dollar A Job

- Embrace Your True Expenses

- Roll With The Punches

- Age Your Money

Another reason why YNAB is powerful has to do with its educational tools and community. You will not find this with financial tools like Mint. There are no Whiteboard Wednesdays to help you understand your money a little better. This is what separates them from the pack in many ways. Our You Need a Budget review goes deeper into the app and the company if you wish to learn more.

Free Personal Accounting Apps

Sverige automaten casino. This app is for you if: https://downdfile585.weebly.com/magic-mermaid-slot-machine.html. You want to transform your budget and get your spending in line with your financial goals. YNAB costs $6.99 a month after a 34-day trial.

It's this methodology around the tool that makes it powerful.

Budgeting Runner Up – Mint

For tracking a budget, Mint is one of the most popular free budgeting tools out there and we wanted to list them because they are free to use.

If you don't have sizable investments, Mint is a very powerful tool that is better for budgeting but less effective for investments. I felt like Mint was fantastic up to a point. Once you focus more on investing than budgeting, Personal Capital has far more tools to help you succeed.

This app is for you if: You want to know where your money is going each month without having to log into multiple accounts. Mint is free.

Best Support Tool – Tiller

Tiller is a service that will connect with your bank and credits card to pull daily transaction data into a sheet on Google Docs. No other service out there offers this. Minitube 3 3 1 x 2. You can choose to start from half a dozen templates or roll your own, but Tiller will update it automatically from 100,000+ financial institutions.

Tiller automates your custom spreadsheet so it fits you perfectly. Photoartista haiku 2 55. Don't change the way you do things to match a tool, add Tiller and bring your spreadsheet into the 21st century.

Tiller is a monthly subscription but it won't inundate you with advertisements or pitch you on their financial planning services as an upsell. (to be fair, other companies need to do that because they are free – the bills have to be paid!)

You get the customization of a financial spreadsheet but the automation piece so you don't need to login to all of your accounts and update everything manually. Removing that hurdle makes money management that much easier. They offer a free 30-day trial.

This app is for you if: You love spreadsheets or have one you've tailored but need a tool to help you pull the data for you. Tiller costs $6.58 per month ($79/year) after a 30-day trial. (here's more about Tiller)

Best Investing App – Robinhood

Robinhood is a stock brokerage that offers commission free trades through their app or web interface. They're like any other brokerage, they use Apex Clearing Corporation, are a member of FINRA, and have SIPC insurance for up to $500,000 like any other brokerage. There is no account minimum, no maintenance fee, and you can even trade crypto if you're so inclined.

They make money by offering a Robinhood Gold subscription service that gets you margin and after-hours trading. If you want to trade stocks, I find it difficult to argue against a Robinhood and their free trades.

For a limited time, you can get a free share of stock from Robinhood.

Best Micro saving App – Acorns

One of the newest innovations in personal finance apps is the idea of a micro-savings app – where you can automatically save small amounts of money and have it invested in the market. The idea is that these apps will figure out how much they can transfer into an investment account without you, or your budget, realizing. It's less active than traditional saving but more effective if you're the type of person who doesn't actively manage your budget daily.

One of the best in class is Acorns, which doesn't rely on a black box “guessing” how much to save. When you make a purchase, the amount is rounded up and transferred. This predictability is often seen as a better process than some other apps, which “guess.” Guessing can be a little scary.

They also have a “Found Money” feature with some partners where if you purchase with a merchant, they may contribute a small bit to your Acorns account.

Money 4 5 5 – Personal Accounting Approaches

Here is our full review of Acorns.

Best Personal Finance Assistant – Trim

If robots can help you invest, perhaps they can help you do some of the more mundane jobs you don't want to?

That's the idea behind Trim, and a whole host of similar apps.

Trim is free to use and they can help you renegotiate your bills like with your cable provider, including Comcast, Time Warner, and Charter. They connect to your accounts, analyze your recurring subscriptions, and identifies areas where you could be saving money. The cable is just the start, they will look at other subscriptions too including your car insurance.

The best part is that they handle the negotiations for you. No more calling Comcast and navigating the phone menu for ages – they do it for you. If you want to cancel, they'll do that for you too.

Here is our full review of Trim.

Summary

There are a lot of apps, many of them free but some of them paid, that will help you save time, save money, and save gray hairs.

Want to hear something funny? When we surveyed of our readers, the number one “app” was Microsoft Excel. Far and away the most popular application for anything – budgeting, financial dashboarding, net worth, whatever category you picked – it was Microsoft Excel.

Microsoft Excel is all about finding a template and customizing something that fits your exact needs. It can be a lot of work but that hands-on interaction means you know the data is pristine. You can rely on tools like Tiller to pull the transaction data too so you get the automation (it works with Google Docs).

I use Microsoft Excel to track our net worth, with Personal Capital pulling the data. It's a nice little set up but it takes some time to get going.

Money 4 5 5 – Personal Accounting Apps

Infographics lab 3 4 8 x 9. The apps on this list are pre-built, faster to get into, and free. If you're starting from scratch, these apps will get you there faster but will not fit you like a glove. Excel is like a custom-tailored suit, these are off the rack.

Other Posts You May Enjoy

Money 4 5 5 – Personal Accounting App

UNDER MAINTENANCE